NYC jobs resumed their return in February and March after a flat four months

COVID-19 Economic Update is a bi-weekly column prepared by economist James Parrott of the Center for New York City Affairs (CNYCA) at The New School, whose research is supported by the Consortium for Worker Education and the 21st Century ILGWU Heritage Fund. Read past installments here.

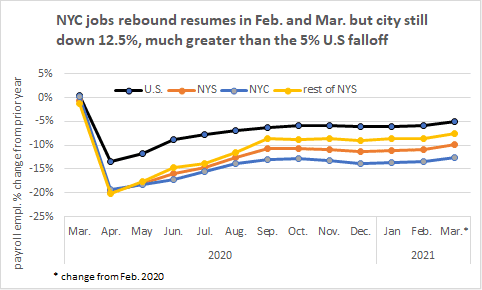

Like the national picture to some extent, jobs have resumed returning in a handful of New York

City industries in the past two months. The latest New York City jobs numbers released on April

15 th showed a 40,000-gain in March and the February numbers were revised upward by 12,000,

to show a 48,000-job gain over January. This follows four months of backsliding after an initial

rebound during the late spring and summer months of 2020 from the low point reached last

April. Still, the city’s payroll job count remains 585,000 below the pre-pandemic level.

New York City’s 12.5 percent jobs shortfall from pre-pandemic levels is two-and-a-half times

the nation’s five percent falloff from February of 2020 to March of this year. Job losses in the

city have far exceeded those in the rest of New York State where the decline over the past 13

months has been 7.6 percent. Sixty percent of New York State’s pandemic job losses have taken

place in the city, which accounted for 48 percent of all Empire State jobs before the pandemic.

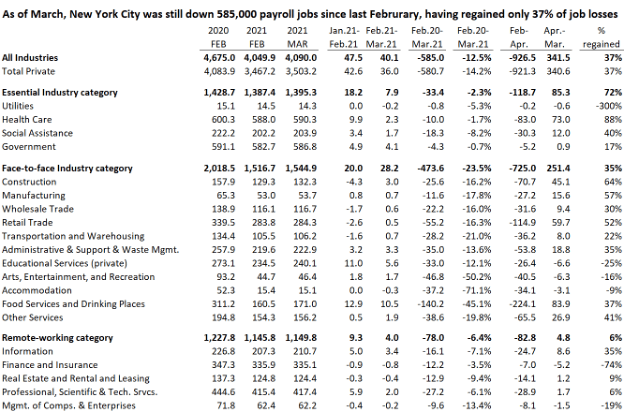

The table below shows the detailed New York City industries sorted into the three categories

useful for analyzing the pandemic economy. It indicates the monthly job gains for February and

March of this year as well as the extent to which the February-to-April job collapse in the early

days of the pandemic has been made up in the months since. Even with the moderate gains in the

past two months, New York City has only recouped 37 percent of last spring’s job losses. Only a

little more than a third (35 percent) of the 725,000 job losses sustained in the face-to-face

industries have been regained.

While every industry had either job gains or very small declines in March 2021, only six

industries had significant job gains in February and March, accounting for over 80 percent of the

net job increases during those two months. Food services and drinking places added back over

23,000 during the two months (but were still down by 140,000 compared to last February).

Private colleges and universities (part of the private education industry) and local government

brought back workers (16,000 and 10,000, respectively) over the past two months after cutting

headcount in December and January as the second Covid-19 surge spread. Home health services

(within health care) added 8,200 jobs, temp agencies (within administrative services) 8,100, and

motion picture production (part of information) 6,100 jobs, with all three industries reaching

their highest levels since the widespread pandemic cutbacks.

The remote-working industries have been much less affected by the pandemic than the face-to-

face industries, with a net decline of 6.4 percent vs. 23.5 percent in the face-to-face industries.

Nevertheless, finance and insurance has reduced employment slightly since last April and the job

rebound in professional, scientific, and technical services has been only six percent. Health care,

on the other hand, has regained 88 percent of the job reduction experienced between February-

April 2020.