Inflation and interest rate increases likely will slow the recovery in New York State’s three regions; New York City’s tech industry has 6.4 percent more jobs than pre-pandemic, but local tech growth lags the nation’s 10.6 percent rise.

COVID-19 Economic Update is a bi-weekly column prepared by economist James Parrott of the Center for New York City Affairs (CNYCA) at The New School, whose research is supported by the Consortium for Worker Education and the 21st Century ILGWU Heritage Fund. Read past installments here.

The release of May New York City employment numbers this week (on June 16th) will likely show a continued moderate job rebound on the heels of the 100,000-job gain between December 2021 and April 2022. At the national level, further job growth in May brought the country’s overall job level within three-tenths of a percent of the pre-pandemic peak. However, last Friday’s report of an unexpectedly large 8.6 percent inflation bump in May compared to May of last year could lead the Federal Reserve to raise interest rates faster and higher than previously expected. If that happens, the job recovery here and around the country most likely will slow considerably, and could stall.

The latest national consumer surveys reflect mounting anxiety regarding inflation and the outlook for the next year. According to the latest New York Federal Reserve Survey of Consumer Expectations, respondents‘ one-year ahead median inflation expectation rose to 6.6 percent last month. The latest University of Michigan consumer survey saw a sharp drop in consumer sentiment and expectations. Consumer assessments of their own financial situation worsened considerably in both surveys. According to the Federal Reserve survey, for example, more consumers expect to be worse off financially a year from now than they are today.

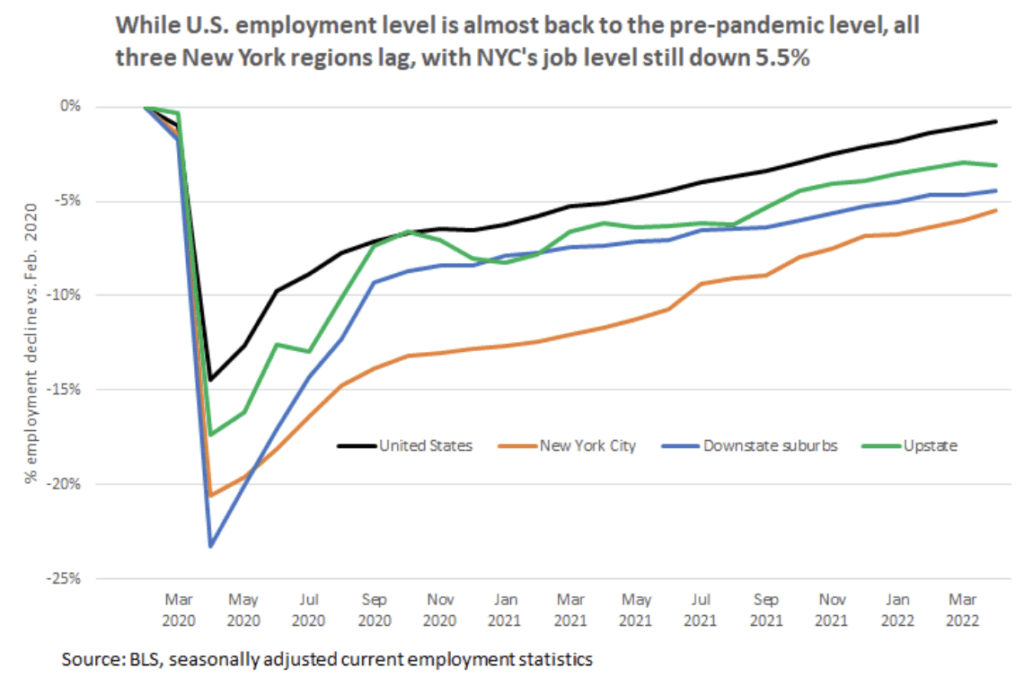

New York City and the rest of the state would be left well short of pre-pandemic job levels should job growth taper off quickly. The first chart below shows that all three regions of the state – the city, the Downstate suburbs, and Upstate – have pandemic job deficits (latest employment level compared to February 2020) of -3.5 to -5.5 percent, much greater than the nation’s -0.8 percent jobs deficit as of April. The employment trend lines in that chart show that job growth in the New York regions roughly has been on a par with national job growth over the past year, but that job declines during the pandemic’s first year were much steeper in New York than nationally. That steep first-year drop relative to the U.S. hasn’t been made up.

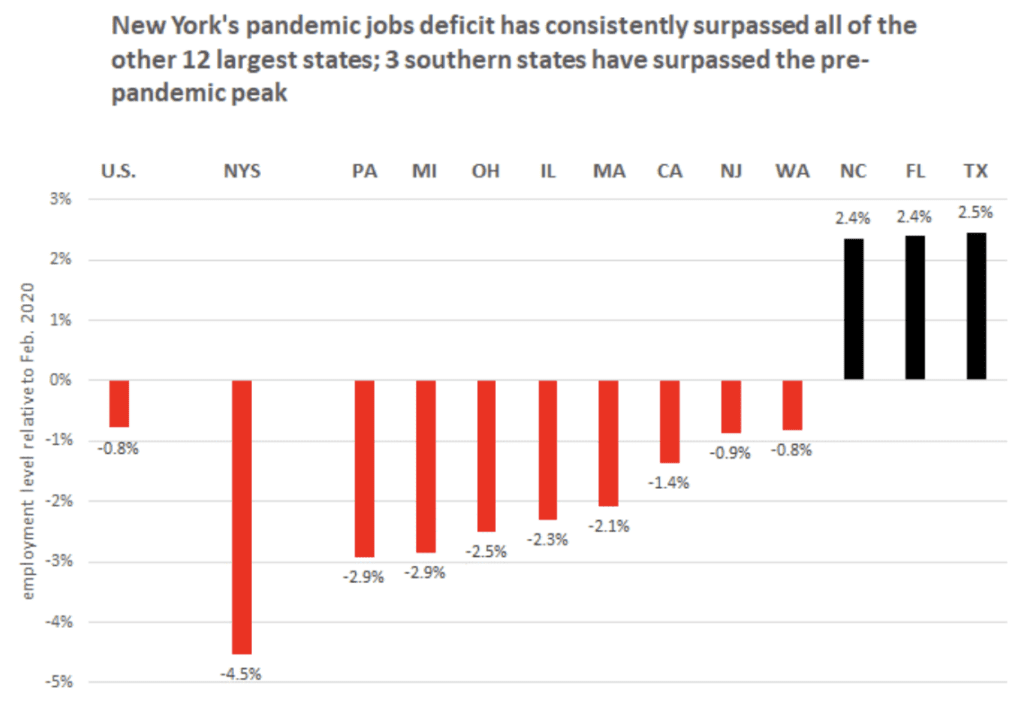

New York State’s overall 4.5 percent jobs deficit as of April continues to lag all of the other 12 large states. (See the second chart.) This has been the case since the onset of Covid-19 over two years ago. Pennsylvania is the next state behind New York with a 2.9 percent jobs deficit, while New Jersey’s -0.9 percent deficit is very close to the national -0.8 percent shortfall. Three southern states – North Carolina, Florida, and Texas – have job levels that are 2.4 to 2.5 percent above where they were in February 2020.

Tech industry one of the bright spots in New York City’s economy

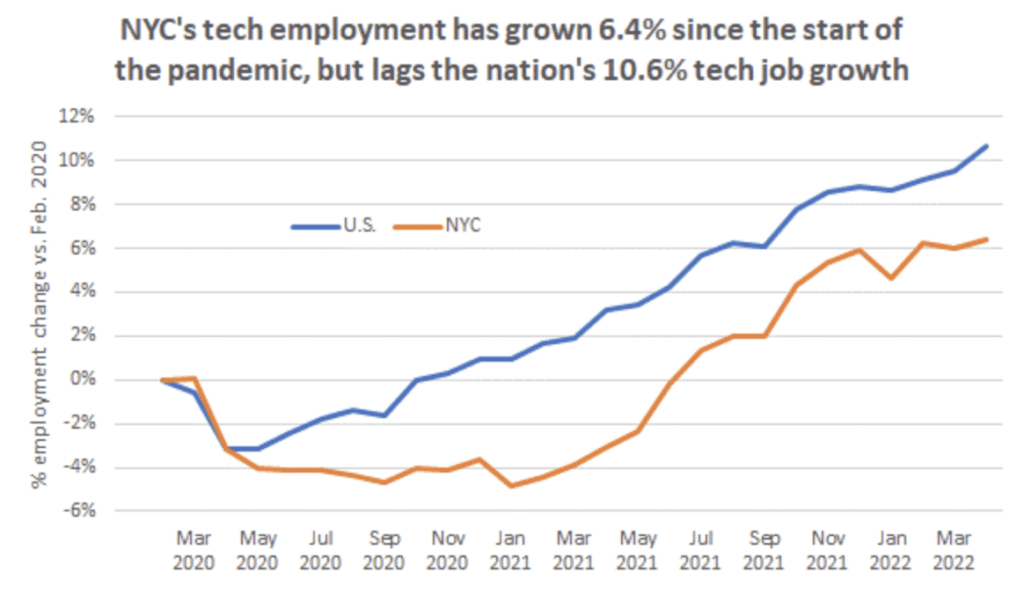

In June of 2021, New York City’s tech industry employment returned to its pre-pandemic level and since then has added 14,700 jobs through April of this year. This put the total employment level for five core tech industries at 247,000 jobs, 6.4 percent greater than before the pandemic. The five core tech industries include computer system design; management and technical consulting; data processing services; web search portals and internet publishing; and software publishing. The chart below shows that New York City’s 6.4 percent tech job growth lags the nation’s 10.6 percent job gain since February of 2020. The city’s share of national tech jobs in April was 4.5 percent, one-and-a-half times the city’s share of total nonfarm employment.

# # #